FIA prepares its Annual Report of Industry Sales from information it compiles from member companies it says have produced an average of 92% of 2009’s total custom forging sales. The report is statistically treated to represent 100% of industry shipments in the custom forging industry. The figures included in the Annual Report do not include forgings produced for captive use or standard catalog products. Components produced via the cold forging process are also excluded from this report.

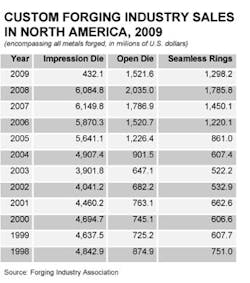

The final revised figures documenting 2009 sales of metal forgings produced by independent (custom) forging plants in the United States, Canada, and Mexico have been released by Forging Industry Association (FIA.) The data was released in April in time with the trade group’s annual meeting. The sales data is organized according to three major forging processes in use by North America’s custom forging operation: impression die forging, open die forging, and seamless ring rolling. FIA bases its Annual Report of Industry Sales on information it compiles from member companies it estimates produced 92% of 2009’s total custom forging sales. Forgings produced for captive use by OEMs or other manufacturers, or for standard catalog products, are not included in the total. Cold forged products also are not included. FIA says it uses statistical analysis to represent 100% of industry shipments in the custom forging industry.Custom Impression Die Forging

The total value of shipments for the custom impression die forging industry during 2009 was $4,382,026,000, a decrease of 21% from the 2008 shipments valued at $4,084,809,000. FIA said bookings of impression die forging orders during 2009 decreased to $4,091,747,000, 33% less than the 2008 bookings valued at $6,125,514,000.

The aerospace sector — which includes engines, aircraft parts, auxiliary equipment, and guided missiles and space vehicles) — represented the largest percentage of impression die forging sales during 2009, up 39% from 33.6% of the segment’s sales during 2008. The automotive industry (passenger cars/light trucks/SUV’s and parts) contributed 19.4% to the sales total, though this customer market declined for the third straight year, from 23.6% of the market segment in 2008 and 30.3% reported in 2007.

Custom Open Die Forging

Total shipments by North America’s custom open die forgers decreased 25% in value in 2009 versus the previous year, to $1,521,616,000 from $2,034,983,000. Bookings of open die forging orders during 2009 decreased 34% to $1,299,885,00 in 2009, from $1,98979,000 in 2008.

in 2009, construction, mining, and material-handling equipment remained the leading consumer markets for open die forgings, representing 16.3% of all sales. However, those markets had represented 23.1% of custom open die forging sales in 2008. General industrial machinery and equipment (which includes pumps, bearings, air/gas compressors, speed changers, drives and gears, and mechanical power transmission equipment) represented 10.6% of the market share, down 11.0% from 2008.

Custom Seamless Rolled Ring Forging

Total 2009 shipments by custom producers of seamless rolled ring forgings amounted to $1,298,484,000, a decline of 27% from $1,785,788,000 recorded for 2008 shipments. Bookings of seamless rolled ring forgings during 2009 decreased by 50% to $999,946,000, from 2008’s $1,983,294,000.

Aerospace engines and engine parts accounted for the majority of seamless rolled rings produced in 2009. That customer segment accounted for 55% of sales in 2009, versus 49.1% of sales in 2008. The second largest customer markets for rolled rings were industrial machinery and equipment and aircraft auxiliary equipment, including missiles. These groups amounted to 6.3% of the total market.