Lots of manufacturing companies want to grow but don't know how or where. If they had infinite resources, they could stumble around and probably find new customers and markets eventually. But they don't, so they should carefully decide where to go before they start.

To grow requires making decisions on investment strategies. For instance, you can modify current products, develop new products, change pricing, increase the sales staff, change sales channels, increase the advertising budget, or find an acquisition. But all of these strategies will require an investment, so it is best to assess where you are now, before spending the money.

As a consultant for the National Institute for Standards and Technology (NIST) in their Manufacturing Extension Partnership (MEP) program, I worked with small and midsize manufacturing companies all over the U.S. for many years. I found that very few used formal marketing strategies, but all of them were interested in growth. Every time I did an audit of a company, there were six basic questions they needed to answer before they could invest in a growth plan.

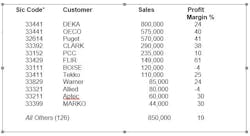

1. Can you profile your best and worst customers? Most industrial manufacturers can tell you all about their bad customers. Why not profile all your customers, then ask the sales department to find more prospects that fit your best customer profile?

Begin by putting together a spreadsheet of all accounts sold in the last 12 months by sales volume, from the smallest to the largest-volume account. It is also very helpful to include the average profit margin percentage of each account before overhead (this is known as the contribution margin or sales minus direct materials and labor).

Assign NAICS or SIC codes to each customer account, which will classify them according to business type. This will give you insight into where your sales strengths are and whom you should target.

2. Monitoring customer wants and needs and needs. For some companies, this is difficult, but it’s necessary for finding ideas for new products and services and increasing sales. It shouldn’t just be up to salespeople to discover market opportunities.

Use lunches, follow-up calls, lost order and quotation analysis as well as sales calls to gather customer information. Post customer feedback on the walls of a conference area at least once a quarter, so all managers and salespeople will understand customer wants and needs.

3. Do you know which market niches to focus on now and in the future? Group the codes into market niches that can be prioritized to determine target markets. You can find out how many companies are in each market by using a database such as Dunn and Bradstreet. For instance, Figure 2 shows that there are 221 prospects in the market niche Tissue/Towel.

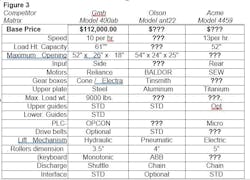

4. Do you know if you have a competitive advantage (and can you compare your products to the competitors products in terms of price delivery in key features model by model)?

To determine competitive advantage, you need to find out:

How many competitors there are for each product line or service.

How your prices compare to their prices, from the customer's point of view.

It not enough to just know who the competitors are. You must be able to compare your specific models to their models by sell prices and all of the specifications and features that are included in the price. In other words, must be able to know what the customer will see when he evaluates all of the quotations side-by-side. Here is an example:

If you can't develop competitive matrix like this example, then you will find out at the point-of-sale whether you have a competitive advantage or not, which may be too late. If you don't have a competitive advantage over specific competitors in the marketplace, you won't be able to grow no matter what strategy you select.

5. Do you know the reasons you lose orders? Keeping track of lost order information is critical to perpetuating long-term growth, and should be a fundamental plank in the foundation of continuous improvement. If you don't know why you are losing orders now, how can you develop a plan to keep customers and get orders in the future?

There is a step-by-step example of a lost order system in my book on this subject, the Growth Planning Handbook.

6. Do you have accurate costs, margins, and pricing information? To develop a good growth plan, you need to know cost and margins for each product line, model, job, service and each customer account. You need this kind of detailed information on both customers and product lines to make customer selection decisions, to change selling and pricing strategies, and to identify product dogs that should be dropped. If you don't have this kind of accurate cost information, it may be dangerous to launch into a growth strategy because sales growth might accelerate margin and cash flow problems and further decrease profitability.

If you were able to answer all six questions with a reasonable amount of information, then you are probably prepared to get into the question of how to finance a new growth program. On the other hand, if you weren't able to answer most of these questions, you probably need to spend more time finding the answers before committing to a growth plan.

Michael Collins is the author of Saving American Manufacturing and The Growth Planning Handbook.