Precision Castparts Corp. has completed its acquisition of Titanium Metals Corporation, it reported, having closed the second cash tender offer for outstanding shares of the primary titanium and titanium products producer.

PCC, which is a forger and investment caster, announced its takeover effort in early November at $16.50/share of outstanding common stock. The acquisition was projected at that time to be worth $2.9 billion.

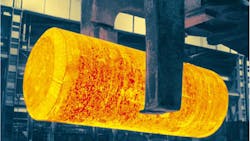

Combining with Timet is a move to expand PCC’s holdings in the aerospace market. In addition to forged parts and investment cast components, several of its other recent acquisitions produce machined components, aerostructures, investment castings, and forgings, as well as machining, testing, and heat treating services.

The initial tender offer closed in mid December, with the buyer having accumulated 150,520,615 (86%) of the outstanding common shares of Timet. Those were organized into a subsidiary of ELIT Acquisition Sub Corp., a specially organized subsidiary of PCC.

The second tender offer was issued to collect more shares, PCC said at that time.

Now, PCC indicated that ELIT Acquisition is the owner of more than 90% of the outstanding shares of Timet. As a result of a “short-form merger” on January 7, Timet is now a wholly owned subsidiary of Precision Castparts and its common stock will cease to be traded.

"Timet will provide us with the titanium capability that has always been a key missing piece of our overall product portfolio," PCC chairman and CEO Mark Donegan stated in November. "As our 2006 acquisition of Special Metals did for us with nickel alloys, acquiring Timet will enable us to streamline our supply chain and better manage our input costs in our core operations. As we continue to grow in the aerostructure market, this supply linkage will present even more of an opportunity.”

About the Author

Robert Brooks

Editor/Content Director - Endeavor Business Media

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others.

Currently, he specializes in subjects related to metal component and product design, development, and manufacturing—including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)