2008 Looks Like a Growth Year

Capital Expenditures for 2008

Click image to enlarge

For 18 years, at the beginning of the fourth quarter, Forging magazine has surveyed U.S. forging industry executives to learn what they know about their companies’ prospects, and from their responses to project the industry’s outlook for the coming year.

One of the notable findings of the 2008 survey is the extent of investment planning for the year ahead. More than 80% of the forgers who responded say that they will be investing in equipment during the coming year. Some 25% of the respondents will place some of this new equipment in expanded plants. Less than 10% of the respondents indicate they are planning no investments in 2008.

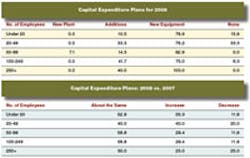

In a table titled “Capital Expenditures for 2008” we show how forging operations of various sizes are planning to invest during the coming year. Because of multiple selections, such as plant additions and new equipment, the figures total more than 100% for each size category.

Borrowing Plans for 2008 by Employment Size

Click image to enlarge

According to the survey, 40.3% of the respondents expect their capital spending to increase in 2007 while 46.3% expect their 2007 spending to match that of 2006. Only 13.4% indicate that they are planning to cut their capital spending in 2007, versus 2006. A table breaks out the data by forging company size.

Plans for funding investment programs are spelled out in a table titled “Borrowing Plans for 2008 by Employment Size” It shows that 39.7% of the respondents plan to stay at their current debt levels, 30.9% indicate that they currently have no debt, 19.1% said they plan to retire debt in 2007, and 10.3% plan to add to their debt to finance capital equipment purchases in 2007.

Investment Plans for 2008

Click image to enlarge

Another table, “Investment Plans for 2008” spells out how the survey respondents are planning to spend their investment dollars. Just over half of the respondents say that they are planning to rebuild or modernize their forging machines. A similar number are planning to invest in forging furnaces and billet/bar heaters. Testing equipment and machine tools are in the buying plans for just over 30% of the respondents.

Brand-new forging equipment is specified in the plans of 27.7% of respondents. Heat-treating equipment and robots were other popular areas of equipment spending plans. Material handling equipment is included in the plans of many forgers. Lift trucks, for example, were listed by 27.7% of the respondents. Cranes and hoists figure in the buying plans of 12.3%.

Representative participation

We consider the findings of this survey to be representative of the views of forgers across the country on the business outlook for 2008. We delivered a questionnaire to every U.S. forging plant. Here are some results:

Among respondents, carbon and alloy steels were the most widely forged metals, at 79.5% and 65.8% respectively. Stainless steels were forged by 46.6% of the respondents, aluminum by 23.3%, titanium by 20.5%, high-temperature alloys by 17.8%, and brass and copper alloys by 17.8%.

Of responding producers, 63.0% manufacture impression- die forgings, 41.1% perform open-die operations, and 12.3% roll seamless rings, with 6.8% performing upsetting, 5.5% reporting they are involved with impact extrusion, and 1.4% performing powder forging. (These totals exceed 100% because many forgers use multiple processes.)

The employment size indicated by respondents was as follows: 26.8% employ up to 20 people, 29.6% employ 20-49, 19.7% employ 50-99, 16.9% employ 100-249, and 7.0% employ 250 or more.

In terms of dollar-volume of sales, 11.9% of the respondents indicated they do under $1 million of business annually, 14.9% do $1-5 million, 19.4% do $5-10 million, 14.9% do 10-20 million, 22.4% do $20-49 million, 13.4% do $50- 100 million, and 3.0% more than $100 million.

Equal or better in 2008

The outlook for 2008 is quite optimistic, according to the vast majority of the respondents. A total of 50% are looking to ship more forgings in 2008 than they did in 2007. Another 42.5% expect next year’s shipments to stay even with shipments in 2007. Only 7.4% are braced for a decline in shipments. The table titled “Forecasts: Forging Shipments 2008 vs. 2007” breaks out the projections by company size.

Major concerns

For several years, our surveys have shown that forgers have been concerned by the high cost of medical insurance for their employees. It continues to be a concern in 2007 — the leading concern in fact, named by 68.5% of respondents; it is projected to be the top concern for 2008, as named by 67.1% of respondents.

Their second-leading concern has been the cost of raw materials, as indicated by 64.4% of respondents for 2007, and 57.5% for 2008. The third-ranked problem during 2007, for 58.9% of the survey respondents, has been the cost of energy. It has been a recurring concern in recent surveys, and retains its importance as 54.8% identify it as a problem for the year ahead.

The issue of raw material lead times was the fourth concern during 2007 for 46.6% of the survey respondents, and 38.4% expect to have to struggle with this problem in 2008.

Rounding out the top five concerns is foreign competition: 39.7% of our respondents say it was a problem during 2007 and 34.2% expect it to remain a problem during 2008. Other concerns listed by survey respondents include workers compensation costs, labor shortages, on-time delivery of forgings, raw-material quality, and U.S. EPA requirements.

Using the Internet, Computer Simulation

In recent years, we have tracked forgers’ use of computer technology, so again this year we asked how forgers are using the Internet and if they are using computer simulation.

A high percentage of forgers are using the Internet for various activities: 100% of the respondents use it for correspondence (e-mail), 90.1% for information searches, 59.2% for procurement, 63.4% for e-commerce, and 18.3% for enterprise management.

A total of 37.5% of the survey respondents indicated they use computer simulation in planning for producing forged parts. As in previous surveys, respondents using forging simulation value its use for reducing of shop-floor trials and after-the-fact analysis in response to process problems encountered during production. on-users explain their choice by pointing to a lack of trained personnel (46.7%), followed by cost concerns (33.3%.)