Metalforming Outlook Holds Steady as Incoming Orders Rise, PMA Reports

Key Highlights

- Manufacturers are cautiously optimistic, with 31% expecting increased orders in the next three months, signaling potential industry growth.

- Major capital investments are being delayed, with a focus on incremental upgrades to improve efficiency.

- Workforce adjustments include slight layoffs and hiring, with automation investments rising to offset labor fluctuations and support increased demand.

- Supply chain challenges are prompting adoption of longer-wear materials and advanced coatings.

- Digital infrastructure upgrades are gaining importance to enhance operational agility and reduce downtime.

Metalforming manufacturers report a cautious but steady outlook for the next quarter, according to the Precision Metalforming Association's (PMA) November 2025 Business Conditions Report. The survey, gathering responses from 85 metalforming companies across the United States and Canada, shows little month-to-month movement in expectations for general economic activity, though respondents are optimistic about incoming orders heading into early 2026.

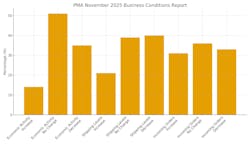

In November, 35% of metalformers indicated they expect economic activity to decline during the next three months, matching October's response. A slightly larger share of 51% anticipate conditions will remain unchanged, while 14% expect an improvement, a small decrease compared to last month. Current shipping activity softened, with 40% of companies reporting lower daily shipping levels. Another 39% saw no shift in volume, and 21% reported an increase.

Despite the softer shipping picture, expectations for future orders improved significantly. Nearly one-third of surveyed companies (31%) expect an increase in incoming orders during the next three months, up from just 21% in October. Fewer manufacturers are bracing for reduced demand, and the number forecasting no change also declined, suggesting that activity may begin to firm up even as broader economic conditions remain mixed.

Workforce conditions showed mild contraction, with 14% of respondents reporting layoffs or short-time schedules, up from 8% in October. At the same time, 26% of companies said they are adding employees, a slight decrease from last month. Lead times were largely stable, with nearly all respondents reporting no significant change from October.

"PMA's November Business Conditions Report shows that members continue to be cautious about expected economic activity over the next three months," said PMA President David Klotz. "This likely reflects ongoing uncertainty in the market due in part to supply-chain challenges, including continued increases in prices of key inputs such as steel and aluminum. However, it is notable that more members are predicting an increase in incoming orders—a positive sign of the industry's resilience."

What This Means for Equipment, Tooling, and Plant Investments

The business conditions outlined in the November report have clear implications for equipment and technology spending across stamping and metalforming operations. When sentiment is steady but not strongly positive—as reflected in the current survey—manufacturers tend to delay major capital investments such as new mechanical, hydraulic, or servo presses. Instead, many plants focus on incremental upgrades that extract more productivity from existing equipment. This often includes automation improvements such as coil-feeding systems, transfer automation, robotic palletizing, and quick-die-change systems, all of which support flexible throughput without requiring major new machine purchases.

Tooling activity typically responds more directly to near-term production forecasts, and the optimistic outlook for incoming orders suggests that demand for dies, die maintenance components, and consumables may begin to strengthen. Rising material prices for die steels and aluminum also influence buying patterns, pushing many manufacturers to adopt longer-wear materials, advanced coatings, or die-monitoring sensors to extend lifetime and reduce scrap.

Fabrication equipment usage—particularly laser cutting, turret punching, and forming systems—may shift as shops balance fluctuating short-term production with the need for operational agility. Plants hesitant to make large capital purchases frequently invest in retrofits or control upgrades, especially when incoming orders improve but long-term economic conditions remain uncertain.

Workforce dynamics are also shaping equipment decisions. With more companies reporting short-time or layoffs, interest in automation continues to rise, especially in material handling. Press tending, coil handling, AMRs, and conveyor upgrades can stabilize throughput when labor availability fluctuates, and these investments align well with plants preparing for increased incoming orders without expanding headcount.

Quality control technologies are another focus area as manufacturers prepare for tighter customer requirements and more complex part mixes. Vision inspection systems, laser measurement solutions, and SPC platforms often see increased attention during periods when shops expect demand to rise but want to avoid costly errors or rework.

Finally, steady conditions paired with strengthening order forecasts frequently drive upgrades to plant software and digital infrastructure. MES platforms, predictive maintenance tools, tonnage monitoring, and advanced scheduling systems offer relatively low-cost ways to improve capacity and reduce downtime, making them attractive options in an environment where capital spending remains conservative.

Full report results are available at https://www.pma.org/public/business_reports/pdf/BCREP.pdf.

About the Author

Laura Davis

Editor-in-Chief, New Equipment Digest

Laura Davis is the editor in chief of New Equipment Digest (NED), a brand part of the Manufacturing Group at EndeavorB2B. NED covers all products, equipment, solutions, and technology related to the broad scope of manufacturing, from mops and buckets to robots and automation. Laura has been a manufacturing product writer for eight years, knowledgeable about the ins and outs of the industry, along with what readers are looking for when wanting to learn about the latest products on the market.