Grounded in Purpose: Stratasys' Secret to Staying on Top

Wandering between the massive exhibits at the International Manufacturing Technology Show (IMTS) in Chicago last September, I was overwhelmed by the wild range of stout machining centers and imposing industrial robots set against backdrops of bright orange and cobalt blue. Power and precision were on display around every corner, permeating the 1.4 million square feet of exhibit space at McCormick Place. Roughly 130,000 attendees jockeyed all week for their chance to peer through tiny windows as spindles sheared steel blocks into intricate, curvy parts.

Over in the convention center’s west wing, looser crowds amassed at more modest booths populated by every kind of 3D printer—from fused deposition modeling (FDM) to stereolithography (SLA) to selective laser sintering (SLS)—each flanked by rows of plastic pop culture figurines or metal octopuses with linked tentacles.

The contrast between the two sides of IMTS was stark: One industry subtracts metal mass at astonishing haste, the other methodically builds up a multitude of complex structures layer-by-layer. But both machining tools and additive manufacturers had one major goal: to get the industry’s attention, particularly the automotive sector. And this year, it felt like 3D printing finally warranted more than a passing glance. Among all the usual Baby Groots and dragons, and Terminator skulls, these exhibitors were actually exhibiting things of serious interest to manufacturers: real end-use parts and components.

Climbing the Mountain

In this department, Stratasys, the originator of FDM and additive industry leader, stood out—and not just because the booth was as big as a cell phone store. The Minnesota-based company displayed sturdy composite parts such as a radome antenna cover for Siemens, an engine manifold for Team Penske of NASCAR, and a satellite door hatch cover for Lockheed Martin.

Seeing all these pieces in one place is a rare occurrence, because Stratasys—which says it has sold more machines than any other 3D printer manufacturer—shares only a sliver of its successful use cases.

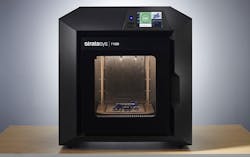

“Our technology gives people a competitive advantage, so we usually can’t say where,” says Pat Carey, Stratasys senior vice president of sales, when pressed about specific manufacturers who have used the new Fortus 380mc Carbon Fiber Edition on display in the Stratasys booth.

Showing off just isn’t Stratasys’ (or Carey’s) style.

“Stratasys is not about the hype,” he says. “We’re releasing these printers and shipping them.”

The company has led the space it invented ever since founder Scott Crump famously fashioned together polyethylene and a glue gun to make his daughter a toy frog in 1989. So at this point, bragging about every time an industrial customer prints a part would be like an assembly worker demanding praise for every finished widget.

That’s not to say additive manufacturing is so ubiquitous that the leading companies should expect everyone to know what to expect.

“We still need to educate the customers to what’s possible,” says Carey.

And the F380mc makes a lot possible. The machine, which started shipping in late August 2018, is a scaled-down version of the Fortus 450, which Carey calls a “Swiss Army knife” for its ability to print ABS, FDM Nylon 12CF (carbon fiber), and ULTEM resins. The F380mc only uses the Nylon 12CF, which is 35% carbon fiber, and another thermoplastic called ASA. The build size is slightly smaller, too: 14 x 12 x 12 in. compared to the 450’s 16 x 14 x 16 in. Those are quite reasonable concessions considering that the F380mc costs about 75% less.

Carey says it was developed in response to customer demand and the market’s willingness to sacrifice variety for a low-cost machine dedicated to carbon fiber. This is perhaps the secret as to why Stratasys has been soaring for so long: Like with its simple blue-collar origin, it exists to do the jobs that need to be done. The toy frog was an inventive way to hold a kid’s short attention span, while lighter, tougher parts demand manufacturers’ attention.

This is precisely where Stratasys is targeting and why it has remained at the top of the market long after the home-printing craze fizzled out.

“There was a hype curve and then the bubble burst, and people were skeptical,” Carey says. “Now you can see people doing real things. We’re all doing real things with our customers. So I’m very optimistic on the industry.”

When it was mentioned to him that Fused Filament Fabrication (FFF) printers are being used at several car factories to provide jigs and fixtures to great effect, he dismissed the trend, saying automakers are driving more toward reliability.

“They are tired of hobby printers on factory floors for 90 days and then [throwing] them away,” he says. “Go to car manufacturers, you see more of our printers there,” he says.

So, we did.

Seeking New Heights

Stepping into Ford’s brand-new 100,000-ft² Advanced Manufacturing Center outside Detroit in mid-April, it felt exactly how I imagine a real-life Wayne Enterprises would: robots, virtual reality, and exoskeletons galore, plus about as many 3D printers as IMTS (25 in all, with more on the way).

This is a critical time for automakers, with political and social demands for cars to be more fuel-efficient, to drive themselves, and yet remain affordable. Which means Ford doesn’t have time for dalliances in emerging tech—it is looking to scale optimal solutions for effortless workflows. And that is exactly what this $45 million innovation dreamhouse is for.

The place methodically vets where those opportunities may lie. But, honestly, it looks more like the 100 or so workers there are just playing with manufacturing’s coolest toys.

Harold Sears, Ford’s additive manufacturing technical leader, oversees the additive goings-on here, trying to manage all the various machines and materials. He’s been at it for nearly 30 years, starting with rapid prototyping of powertrain components in 1990.

“Nothing can keep cars from getting out the door, so we have to be very careful that this is not perceived as a distraction, but will enhance the business,” Sears says.

Ford is currently running 3D printers in at least 30 of its factories, which seems like a good sign that it is more than just a trend. These are real manufacturing tools for the carmaker, and they are treated as such.

For Ford, Sears says, it’s all about the experience, the manufacturing muscle memory. Even 3D printers cannot bypass the need for those.

For evidence, he pulls out an electronic parking brake bracket from a Carbon M2 printer, which will be used for the new Mustang Shelby GT500. Sears notes that it reduces weight by 60%.

“The ‘so what’ for this is the process we had to go through to actually produce production parts, understand machine-to-machine variations, and keypath the process,” Sears says. “It’s a big thing. We learn so much doing this. It really paves the way for bigger and better applications.”

Getting the timing right is also huge, as the operators must adhere to a strict cadence to pull a part from the build zone and drop into the post-processing washer to clear away support material or whatever the next step is. Because something else is always in the queue.

“We don’t want a job to finish right before the operator goes to lunch,” explains Sears. Ford uses an internal scheduling system, and workers are given a production schedule for the week.

Some jobs can take 14 hours, and certain printers will have 20-70 different parts for four or five internal customers, Sears says. So the operators, a mix of technicians with two-year degrees and engineers with at least a four-year degree, take longer prints for overnight.

Between the large EOS P770 and Desktop Metal Studio System, Sears points to a Stratasys F370. Along with the F170 and 270, it’s part for the F123 Series that was voted as a NED Innovation Winner in 2018. The printers accept four different materials, and the 370 allows for the additional high-impact engineering thermoplastic PC-ABS.

The key selling point is that it uncomplicates 3D printing for typical users. At the time, we wrote “no special expertise in 3D printing should be necessary, due to a streamlined design and Stratasys Insight software, allowing nearly any CAD file to be used, and GrabCAD Print, which eliminates wasting precious time on file conversion and STL prep.”

“A teammate gave me a three-minute tutorial, and I was printing. The printer is goof-proof,” said an NED reviewer.

With more than two dozen printers to manage, it’s crucial that the different models don’t require complex vendor training and certification.

Sears does say once training is over, using any of the machines every day “becomes second-nature to them, so when you bring a new one in, they’re really excited to learn and come on board with it.”

Sears agrees the F370 “is extremely easy to use and very robust” and has been deployed at Ford plants to make tooling set-up and try-out pieces, small fixtures, gages, and other industrial materials that may wear out.

Ford has even used additive to challenge the traditional sand molds that are used to create parts for exhaust systems. Getting the right size and form happens much faster this way.

“Instead of changing tooling, engineers send us four or five designs, and we do the testing all in parallel,” Sears says. The material cost is also about $200.

“It is enabling us to meet our aggressive timelines,” Sears says.

Teaching from the Top down

Ford has the luxury of having high-tech research labs and testing out several different methods and machines. Some companies just need one killer use case, so Stratasys has taken its strategy of scaling down the Fortus 450 to the 350 and done the same for the F123 Series by launching the F120 this past month. The cost is $11,999, so about a third less than the F370. The desktop printer uses fewer materials (ABS, ASA, and SR30) but comes with separate large filament containers that allow 250 hours, 10.5 days, of continuous printing.

No one would need that now, so it’s more about not having to change out the material, though maybe an automated system could be developed in the future to truly take advantage of the near-endless extrusion flow.

The machine, which will be delivered in July, has been tested for more than 1,000 hours and Stratasys says is three times faster than competitive systems and creates reliable, accurate, and repeatable end-use parts.

The F120 also has the benefit of the intuitive touchscreen and software to allow trainees to immediately start using it and for shared work groups to access jobs remotely and iterate quicker.

And it’s affordable enough for schools, which has Gina Scala, director of global education, excited.

“There’s a huge skills gap with what employers need and what schools are preparing students for,” Scala says. “This printer, which is 40% less than the F170, allows us to get that into more places.”

She is confident the industrial tool will produce the same quality as those coming out of large companies’ R&D labs or a service bureau, but with a lot less stress.

“The focus now can be on teaching and learning, not tinkering and fixing,” Scala says. “It’s really about empowering the next generation of designers, engineers, and educators.”

Along with the F120, Stratasys has made its V650 Flex Stereolithography 3D Printer publicly available. Their service bureau arm, Stratasys Direct has used the machine for about five years, and it has been one of the companies best kept secrets.

The system has a 20x20x23 in. build volume and has made more than 150,000 parts over 75,000 hours of use.

“It’s not the sexiest machine out there, but it was very purpose-built,” Carey says.

The laser that draws the part from the resin moves at 1,000 inch/sec, while Carey says the next closest competitor is about 400-500 inch/sec.

“If you look at any industry as they grow and commoditize, usually an industry leader emerges that focuses more on the customer than on a proprietary platform,” Carey says. “When you focus on the customer, you focus on transferring expertise.”

To that end, even Stratasys has learned something new with the V650. It has an open vat configuration, making the materials open source, a definite change in strategy—and one that is critical for customers like Ford.

“I don’t want to be locked into [proprietary] material,” Ford's Carey says. “I should be able to use any material I want.”

And Stratasys appears to be listening and learning. And that is the real secret to any manufacturer staying on top: “You’ve got to focus on helping the customer get their job done and getting it done quickly,” Carey concludes.

About the Author

John Hitch

Editor, Fleet Maintenance

John Hitch, based out of Cleveland, Ohio, is the editor of Fleet Maintenance, a B2B magazine that addresses the service needs for all commercial vehicle makes and models (Classes 1-8), ranging from shop management strategies to the latest tools to enhance uptime.

He previously wrote about equipment and fleet operations and management for FleetOwner, and prior to that, manufacturing and advanced technology for IndustryWeek and New Equipment Digest. He is an award-winning journalist and former sonar technician aboard a nuclear-powered submarine where he served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723).