U.S. Manufacturing's Productivity Gains Are a Myth

The U.S. manufacturing sector is far from the basket case it is sometimes made out to be on the campaign trail. But it's important to realize that it isn't exactly going gangbusters, either.

The everything's-OK line about U.S. manufacturing goes something like this: Yes, lots of manufacturing jobs (7.3 million, to be precise-ish) have been lost since employment in the sector peaked in 1978, but real manufacturing output is at an all-time high. So the manufacturing sector is doing fine -- it's just that thanks to automation and other technological advances it has gotten much more productive and thus doesn't need as many workers.

I wrote last week about doubts over whether manufacturing output really is at an all-time high -- the numbers are skewed by huge gains in real output in computer and electronics manufacturing that mainly reflect quality adjustments made by government statisticians, not increases in real-world sales. It turns out there are also problems with the claim that U.S. manufacturers have gotten all that much more productive. I'll let Michael Mandel, chief economic strategist for the Progressive Policy Institute, explain (from a piece published in Technology Review):

Yes, it’s true that since 1994 manufacturing labor productivity has doubled. But if you measure something called “multifactor productivity” you get a different story. Multifactor productivity takes into account how efficiently a factory uses all its inputs -- not just labor but also equipment, buildings, energy, purchased parts and services, software, and research and development. Because it includes a wider scope of inputs and costs, multifactor productivity is a better indicator of how innovative and competitive an industry really is.

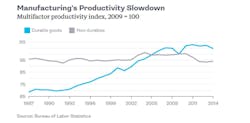

Here's what the measure, which is adjusted for inflation, looks like for durable goods and non-durables manufacturing since 1987:

These indexes allow one to see productivity changes over time in a sector, not to compare different sectors' absolute productivity. So the fact that durable goods multifactor productivity in 1987 was 69 and non-durables' was 96 means not that durable-goods manufacturers were less productive than non-durables manufacturers in 1987 but that their productivity increased a lot more from then through the index year of 2009. Which I know is a little confusing, but the alternative -- charting year-over-year changes in the productivity index -- makes it harder to see trends.

So durable-goods manufacturing saw big multifactor-productivity gains in the 1990s that appear to have stalled out just over a decade ago, while non-durables productivity hasn't really budged much over the past three decades. Non-durables are things such as food, clothes, chemicals, paper products and plastics. Here are a few key sectors:

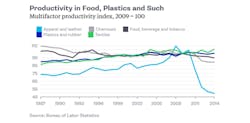

Other than apparel manufacturing, which saw productivity first rise sharply and then collapse as the industry itself more or less collapsed in the U.S. after 2000, these non-durables sectors haven't seen huge changes. Productivity has been on an upward trend in textiles and plastics and rubber, a downward trend in chemicals and food and beverages. Overall, it's a wash.

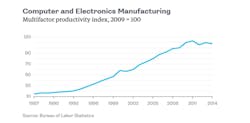

In durable goods, computer and electronics manufacturing is such a huge outlier that I'm going to give the sector its own chart.

So that's huge productivity gains in the 1990s and early 2000s, which drove similar if not quite so spectacular overall productivity gains in durable goods, followed by a plateau. As with the big gains in real output for computer and electronics manufacturers (productivity equals output divided by inputs), these are largely the result of adjustments for quality improvements in computers, semiconductors and the like. The quality improvements are real -- an iPhone is as powerful as a 1985 supercomputer -- but the adjustments do raise questions about what exactly the productivity numbers signify. They don't necessarily mean, for example, that computer and electronics manufacturers in the U.S. are actually growing, or succeeding in international competition.

As for makers of other durable goods, it's again more of a mixed picture. Here are a few sectors of interest:

Transportation equipment makers have seen significant productivity gains since the 1990s. The others, not so much. On the whole, the U.S. manufacturing sector does not appear to have been a hotbed of innovation and productivity gains in recent years. It has gotten by with fewer workers, but in many cases that seems to have been more about managing decline through layoffs and plant shutdowns than boldly leaping into the automated future.

There is a positive way to look at this. Mandel argues that many digital technologies are only now reaching the point where they can help old-line manufacturers make big productivity gains. Together with the nascent "reshoring" wave in which multinationals choose to relocate production closer to markets, this could conceivably lead to a U.S. manufacturing boom in the future. But let's be clear: There isn't one happening now.