After Fiat Chrysler on Monday became the latest of the erstwhile Big 3 American carmakers to redirect investment to the U.S. from Mexico, Jefferies Group LLC had a message for investors:

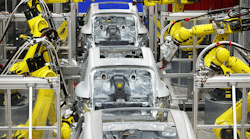

"Sell humans, buy robots.''

The firm argues in a note to clients Tuesday that the millions the manufacturers will spend on new or upgraded plants will largely go toward making factories more automated and not create as many jobs as President-elect Donald Trump may be expecting.

"With wage pressures building alongside a strong dollar, U.S. companies will need to invest in automation," the team, led by Chief Global Equity Strategist Sean Darby wrote.

The note is in response to Fiat Chrysler Automobiles NV's announcement that it will invest $1 billion in U.S. factories that will create 2,000 additional jobs in the Midwest. The move comes after Ford Motor Co. said it will invest in Michigan production and canceled plans to build a $1 billion plant in Mexico. In each case, Trump took to Twitter to take credit for or express his pleasure in the moves as evidence that manufacturing is about to blossom in America.

Wall Street is skeptical that will produce jobs for Midwestern autoworkers.

"Mandating a physical task be carried out in a high-cost labor market in 2017 is simply going to increase the chances the task is automated," analysts at Sanford C. Bernstein & Co. led by Michael Parker wrote last month. "The activity may come 'home,' but there are simply no jobs to steal," they said, adding that the U.S. could end up doing what China does and spend more on robots.

Jefferies says the carmakers' decisions to redirect investment to the U.S. flows largely from the prospect for lower American corporate taxes and the threat of import tariffs under the Trump administration.

"The pressure from the new President to foster domestic production versus overseas investment is directly related to proposed changes to corporate tax,'' Jefferies writes, adding that the border tax Trump has pushed for would provide further incentive to build goods in America.

"If companies do invest in the U.S. they are going need to make significant productivity gains by trying to lower unit labor costs," the team concludes.