The Chinese concept that crisis is defined as both "danger" and "opportunity" may be of little comfort to the CEO's of industrial machinery manufacturers. With the dawn of Industry 4.0 comes the realization that business models will inevitably change as Big Data transforms manufacturing processes.

For industrial machinery OEM's, the adjustment to the new IoT paradigm cannot simply be based on incremental product innovation. Extra R&D budgets to develop more features and functionalities are insufficient given the magnitude of change. Industry 4.0 is an industrial revolution and revolutions are marked by the fall of existing institutions and the rise of new elites. With the writing on the wall, the need to machinery manufacturers to adapt is now well understood, although the options for many are unclear.

On way to adapt is by embracing Hardware as a Service. HaaS is not new, but until now it has been applied primarily to the ICT sector. At Presenso, we have noticed that an increasing number of customers and partners are now considering HaaS, even if they are not yet using the term.

Currently, a piece of equipment or replacement is typically sold to replace one that is aged or broken. The transaction ends with the delivery of the equipment (either directly or through a channel partner). In cases where the equipment is bundled with a service agreement, this is for a finite period-of-time. Many OEM's have transactional relationships in commoditized markets, with limited upside for margin growth.

IIoT Predictive Maintenance as Competitive Differentiator

The micropatterns hidden within the terabytes, petabytes, and exabytes of sensor data generated by industrial machines can tell us when a machine is likely to fail. Until now these patterns were imperceptible to even the most advanced statistical packages. Data scientist lacked the tools to find these patterns and industrial plants lacked the data scientists to even try. Now these tools exist, and they can be accessed by end-users without the need for Big Data experts. Advances in Artificial Intelligence and Machine Learning have opened up the field of Predictive Asset Maintenance, paving the way for HaaS.

IIoT Predictive Maintenance is gaining traction in the marketplace and growth is expected to accelerate over the next few years. According to IoT Analytics research, the current global market for IIoT Predictive Maintenance was about $2 Billion in 2017 and is expected to reach $11 by 2022.

Underlying this growth are two trends.

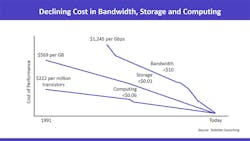

First, the dramatic decline in bandwidth, storage and computing costs mean that operational factory data can now be stored, transported and analyzed at a small fraction of the cost from just a few years ago. Furthermore, the cost of IoT sensors has declined from $1.30 in 2004 to a projected $0.30 by 2020.

The second catalyst for the growth in IIoT Predictive Maintenance is the application of advanced Machine Learning to the industrial domain. Traditionally, these topics were confined to academia. In recent years, market forces have caused the commercialization of Artificial Intelligence. There has also been a surge in investor funding for this sector, driving further innovation.

In some ways, the market is still in its nascency. According to a research reported conducted by PwC in Germany, the Netherlands and Belgium, only 11% of Predictive Maintenance (PdM), is IIoT Predictive Maintenance. Chart 2 below depicts the maturity of PdM models.

How does HaaS work?

Today, if you are pump manufacturer, even if your pump has the best features, at some point a competitor can design a better and cheaper version. With HaaS, industrial machinery is equipped with multiple sensors and connected to the internet cloud. Now you are no longer selling a product; you provide a service. In an outcome-based scenario, you track the performance of a single pump or multiple pumps in an industrial plant. The value that you provide is to monitor the health of the pump and to proactively alert the plant to evolving degradation or failure.

From a customer perspective, advanced knowledge of asset failure means that repairs can occur before the shutdown of a production line or even an entire facility. If the root cause of a failure can be isolated in advance, then production loads can be adjusted, parts ordered, and repairs scheduled with minimal disruption to production. The result is higher machinery uptime and increased revenue.

Those OEM's that succeed with the HaaS model will benefit from recurring revenue models and reduced sales cycles. The most successful OEM's will be the ones able to de-commoditize their product catalogs and create subscription-based services lines of business.

I believe that this will resonate with the market. When I speak with manufacturing executives, I have noticed a shift in conversation from reducing downtime to increasing uptime. This signals the strategic importance of Industry 4.0. In the past, traditional Predictive Maintenance was a cost line item and the benefits were seen in the context of reducing downtime and improving efficiencies. With Industrial IoT Predictive Maintenance, the focus has shifted to uptime and increased production yield. Higher revenue is the driver and KPI.

Challenges Implementing HaaS

Of course, with the new opportunity bring danger, especially as we enter this era of disruptive change. We will address each of the challenges individually:

1.) Will HaaS disrupt the supplier ecosystem?

There is an organizational divide between Operations and Technology in the industrial world. The scenario of hardware OEM's adopting a software operating model could result in alliances and new areas of competition. Software and hardware vendors could collaborate on their product development and go-to-markets, thereby forcing a re-alignment of the vendor landscape. There are several IIoT platforms available and the entry of hardware vendors into the market could create confusion. Will there be standardized software used by multiple hardware vendors or will individual hardware vendors build proprietary tools? As customers adjust to this new reality, demands for single source solutions may result in industry consolidation and vertical integrations.

2) How will industrial plants manage their OEM suppliers?

If hardware vendors start offering their own IIoT Predictive Maintenance solutions, there may be resistance on the part of industrial plants who are unwilling to operate multiple solutions. In the Future of IIoT Predictive Maintenance Research study of maintenance and reliability professionals that was conducted by Emory University students and sponsored by Presenso, survey participants were asked to select between one IIoT Predictive Maintenance solution that fits multiple machines and one solution installation for each machine. The overwhelming majority of respondents (96.3%) selected solution installation for multiple types of machines.

3) Can hardware specific solutions provide a holistic factory view?

When an IIoT Predictive Maintenance solution is limited to one piece of equipment, the root cause of a failure may not be found in an adjacent system not directly connected to the one supplied by the hardware OEM. For instance, a pump may be displaying abnormal behavior because adjacent machinery is overheating due to an electric wiring malfunction. In this case, the pump vendor may detect evolving failure, but not a root cause that isn't directly connected to the pump.

The requirement on the part of industrial plants to limit the number of Predictive Maintenance solutions is not only based on the ease of management, but also the accuracy of results. This is likely to pose a major challenge for hardware vendors adopting a HaaS model.

4) How will HaaS impact the adoption of IIoT infrastructure architecture to support multiple OEM's?

In Tom Raftery's 2018 IoT predictions, he suggests that although there have been advances in open standards and architectures, integration will continue to be challenging. There are at least 10 large vendors with IIoT platform offerings and lack of common standards. This poses a challenge to both the hardware OEM and the industrial plant that needs to integrate multiple IoT applications while balancing existing legacy systems. According to an assessment McKinsey & Company, larger customers will have negotiating leverage and "can demand interoperability when they write specifications and procure IoT systems."

5) Who assumes failure risk?

When a technology neutral IIoT Predictive Maintenance solution detects evolving failure, its primary function is to alert the relevant maintenance and reliability professionals. As vendors shift to providing prescriptive guidance on asset repair, will the OEM be expected to assume responsibility for failure? Furthermore, without Root Cause Failure information about other equipment in the plant, there is a risk of penalizing the OEM for breakdown related to third-party machinery.

The issue of risk also extends to maintenance. If plants expect OEM's to bundle maintenance as part of the HaaS, this would require a service model that many OEM's cannot support effectively. In the software arena, troubleshooting and patches can be managed via remote. In the case of hardware, although it can be shipped to geographically disbursed locations and data can be analyzed anywhere, the requirement for local repair limits the OEM's flexibility to provide an end-to-end service solution.

6) Can Hardware OEM's develop new competencies?

To provide a Predictive Maintenance solution requires developing deep expertise in the disciplines of Artificial Intelligence and Machine Learning. Traditional hardware vendors lack this capability. Smaller OEM's may be at a competitive disadvantage if they cannot afford to invest in R&D. One likely scenario is for OEM's to integrate third party IIoT Predictive Maintenance applications into their hardware offerings

Summary and Conclusion

It is over-simplistic to assume that every hardware OEM will be able to offer HaaS, and it could lead to vendor consolidation and vertical integration. Some vendors will not be able to adjust to new business models given their operating models and cost of capital.

It is time for OEM, component, machine and hardware vendors to consider HaaS. Whether it means partnering with IIoT Predictive Maintenance solution providers or building internal competencies in data science and analytics, the era of Industry 4.0 will make HaaS an essential component in the delivery of industrial equipment.