Twenty-first-century manufacturing is really a kind of sci-fi dream come true. Today’s industry is absolutely brimming with fancy new gadgets and technological miracles designed to serve one purpose: make better products.

And make them faster and cheaper than ever before.

The one key trick to accomplishing that goal, of course, is to create a system that ensures all your equipment is performing perfectly and predictably—that the plant is up, that the machines are accurate, and that all of these expensive assets are doing their jobs exactly as they are supposed to do them.

This should be easy. Manufacturers have a world of analytics at their disposal to serve this end. They have a swarm of cheap, sophisticated sensors ready to monitor everything they need. They have smart tools and Internet-connected everythings. They even have the power to track the use of hand tools on the other side of the globe in real-time. It’s the future. It’s amazing.

With all that, surely there are no blind spots left. Surely everything is illuminated and clear all the way across the floor, right?

Not even close.

“About half of the companies I walk into still have no idea what is happening in their machines,” explains Jeremy Wright, director of product management for factory maintenance expert, Advanced Technology Services (ATS). “They realize that they are in trouble in the marketplace and that they are not getting the numbers they should be getting, but they don’t know how to get out of it.”

Despite all of the progress the industry has made, he says, there are still giant blind spots. Machines are still running out of spec, equipment is still breaking down, and plants are still losing productivity.

It’s a problem, he believes, rooted in maintenance.

These plants are still operating in what Wright terms a “reactive” mode. They chase problems across the plant only after they occur, sending out maintenance workers and experts, wrenches in hand, to diagnose problems with equipment only after they have stopped working—when it is already too late.

This is a very 20th-century mindset that still maintains a stronghold in 21st-century plants.

“The overall goal here is get away from reactive and more toward preventative maintenance—and more than that, even, toward proactive maintenance,” Wright says.

Now, preventative maintenance isn’t a new thing. The idea behind it—performing regular maintenance on machines before they break so they won’t break—is probably as old as manufacturing itself.

It’s at least old enough now to have some pretty concrete calculations of its value.

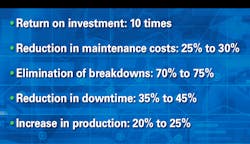

According to Fluke—which manufacturers a range of products designed to diagnose equipment issues before they happen—a good preventative maintenance program can increase productivity between 35 and 45% while reducing maintenance costs between 25 and 30%.

In an industry scrambling to shave fractions of percentages off cycle times and productivity losses, these are gigantic, preposterous numbers.

“We know for a fact that if we can move the needle away from reactive maintenance, it becomes cheaper to run the plant,” Wright explains. “And we know that if companies don’t focus on moving the needle away from reactivity, they will fail to their competitors.”

If we connect this old idea of preventative maintenance to all of the tools and tricks of today’s smart manufacturing environment, the solution to all of this should be simple: Just connect your machines, lean on analytics, and reroute your maintenance workers to keep machines running.

It doesn’t seem like it should be an issue anymore. But, as Wright notes, at least half of his clients are still in the dark.

So the big question is: what is causing this gap to persist?

Mind the Gap

Weishung Liu is in the perfect position to answer this.

As a product planner for Fluke Connect, Liu is responsible for uncovering the hidden needs of the market and then help design new products to meet them.

“My role here is to understand what the customer needs to do their jobs better, faster, smarter,” she explains.

For Fluke, of course, this inevitably comes back to the preventative maintenance issue. So the hidden issue Liu is out to solve is the same as ours—with all of the tools at our disposal, why aren’t manufacturers monitoring their equipment?

She thinks she has an answer: Fixed sensors.

“These sensors are used for high-criticality assets—meaning that if this particular piece of equipment fails, your plant is essentially shut down,” Liu explains. “These are also very high-cost, high-commitment installations.”

And that makes sense. If productivity is tied directly to these machines, then investments have to be made.

But focusing on those key pieces leaves a lot in the dark. All of those motors, switchgear, transformers, pumps, and other tier-II assets stretching across the plant may not show up high on the criticality list, but they can do some real damage when they go down.

“People are missing the effect of the small,” ATS’ Wright notes. “We spend all of our time and money and energy focusing on the top 10% of our most critical equipment, but if we take a step back and actually did some analytics, we see that all of these little things really add up to some major issues.”

The problem here, Liu’s research finds, is that monitoring this equipment can be difficult, expensive work.

To that point, she highlighted an example of one of the companies she researched. The facility recently installed 50 fixed sensors on some of these lower-criticality pieces in an effort to build a stronger predictive or proactive maintenance program. It was a solid move toward world-class operations, but a costly one.

“The sensors themselves weren’t expensive,” Liu says. “But what they underestimated was the cost of wiring, which they said was upward of $200,000.”

The other problem was the IT issue.

“To put a system in there, you have to work with IT people, and the IT people have a lot of restrictions and limitations,” she said. “There was a lot of red tape and it caused a lot of headaches just to get it set up.”

So, a lot of bureaucracy and a lot of money. And there, she realized, she had the reason for the maintenance gap.

She also had her roadmap for a solution.

“This was the first inkling we had that we could do it differently,” Liu says. “So we asked, ‘What can we do to make it less of a barrier for people to adopt?’”

The Solution

For Liu and her Fluke Connect team, the answer to this puzzle came in the form of a suite of connected products called Fluke Condition Monitoring. The line includes a host of Fluke equipment—a whole range of sensors, probes, and clamps that can monitor everything from voltages and currents to power and temperature—plus a gateway device to send all of that data to the cloud and the Fluke Connect software to link it all together and translate it into actionable intelligence.

The system allows manufacturers to deploy a fleet of low-cost sensors wirelessly throughout the plant to monitor equipment and send vital data to any worker with a computer or smartphone. Basically, it brings these lower-level assets up to the 21st century.

The real differentiator for this product, Liu says, is that the system uses semi-fixed or portable sensors, rather than the more invasive permanent installations used on critical equipment. This means the devices can be installed quickly and easily on any motor, drive, or tier-II asset and be connected without much IT interference at all.

Taken on its face, it looks like the answer to the maintenance gap question.

In the process, though, it may unlock even more potential.

SMB Disruption

The Fluke Condition Monitoring system is just entering the market now, but it has already raised the prospect of some serious—and important—disruption in the maintenance space.

The system is enabling companies to not only bring their non-critical machines up to 21st century standards but is allowing a whole new market to explore the power and benefits of the technology.

“Traditionally, fixed sensor systems are priced at a point where only the large people can really play in the market,” Liu says. “What we’re doing now is opening up that market to small and medium-sized companies on both the hardware side and the software side.”

In this light, the manufacturing industry might be out of excuses. The technology is all there, ready to be deployed, ready to shed light on all of these operational blind spots and bring productivity up to today’s smart expectations. All that’s left is to rally the maintenance culture behind it and bring these processes into the future.

“Removing these barriers, it’s more than just the technology that changes,” Liu says. “It changes behaviors.”

About the Author

Travis Hessman

VP of Content, Endeavor Business Media

Travis Hessman is the VP of Content for Endeavor Business Media. Previously, Travis was the Editor-in-Chief for Industry Week and New Equipment Digest as well as the Group Editorial Director for Endeavor's Manufacturing Group.

He began his career as an intern at IndustryWeek in 2001 and later served as IW's technology and innovation editor. Today, he combines his experience as an educator, a writer, and a journalist to help address some of the most significant challenges in the manufacturing industry, with a particular focus on leadership, training, and the technologies of smart manufacturing.