New orders for machine tools in the U.S. surged 56% in September, adding to a total sales value of $497.25 million. This marks the second consecutive month of rising orders and a 52% year-over-year increase compared to September 2015.

The spike in this latest USMTO report from AMT – the Association for Manufacturing Technology – is largely pinned to the sales driving force of the biannual International Manufacturing Technology Show (IMTS), which took place September 12-17.

"Every two years in September, the impact of IMTS – The International Manufacturing Technology Show on the industry is reflected in the USMTO report. I call it the 'IMTS Effect'," said AMT President Douglas K. Woods. "This year's uptick in orders indicates manufacturers are eager to see and confident enough to invest in the latest manufacturing technology to improve their operations and products, but the momentum will slow heading into 2017."

All major customer sectors realized dramatic increases in order levels in September, according to the report, except the auto industry. This supports news that the strongest market over the past 20-month downturn has hit the pause button due to a shift in consumer demand from cars to trucks.

"Overall, the year is expected to finish down about 8%," said Pat McGibbon, AMT Vice President of Strategic Analytics. "We won't see the December surge we usually see when manufacturers rush to take advantage of expiring tax incentives because they were extended or made permanent in 2015."

"Top industry analysts at AMT's 46th Global Marketing and Forecasting Conference in October projected flat to modest growth by the end of 2017," McGibbon added.

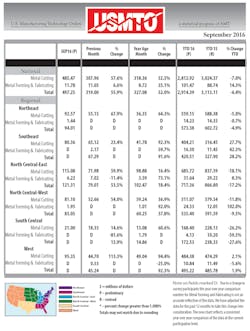

September 2016 manufacturing technology orders were valued at $497.25 million, compared to $319.00 million in August and $327.08 million in September 2015. Year-to-date orders for 2016 stand at $2,914.39 million, a 6.4% decline compared to the same point in 2015.

AMT

In the Southeast region, September new orders for metal-cutting equipment rose 23.4% from August, and 92.3% from September 205, totaling $80.36 million for the month. For the year-to-date, the region has booked new orders totaling $420.51 million, up 28.2% versus nine months of 2015.The North Central-East region's September total manufacturing technology new orders showed a 53.5% increase over August and an 18.4% increase over September 2015, finishing the month at $121.31 million. With that, the region's nine-month new order total for 2016 is $717.4 million — a 17.2% decline versus the January-September 2015 total.In the North Central-West, new orders for metal-cutting equipment during September totaled $81.1 million, up 54.0% from August and up 36.9% from September 2015. Total manufacturing technology orders in the region through nine months of 2016 stand at $535.4 million, a decline of 9.5% versus the comparable total for 2015.The South Central region reported $21.0 million worth of new orders for metal-cutting equipment during September, 14.6% more than during August and 60.6% more than during September 2015. The year-to-date total for manufacturing technology new orders in the South Central region is $172.53 million, or 27.6% less than that region's January-September 2015 total.Finally, the West region's new orders for metal-cutting equipment during September totaled $95.35 million, an increase of 113.3% over the August total, and of 94.4% over the September 2015. Through nine months of 2016, the West region's total new orders for manufacturing technology stand at $495.22 million, which is just 1.9% higher than the comparable total for 2015.