It's getting harder to blame America's persistently weak rate of productivity growth on faulty measurement, at least in the nation's manufacturing sector.

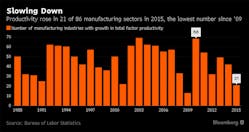

Total factor productivity – a measure of efficiency that compares firms' output to the combined inputs of labor, capital, and the intermediate purchases used to produce those goods and services – rose in just 21 of 86 manufacturing industries tracked by the Labor Department in 2015 from the previous year. That was the fewest since 2009 and compared with twice as many a year earlier, according to an agency report released Thursday.

Unlike the government's quarterly figures on output per unit of labor, the data account for changes in less easily measurable factors that could impact performance such as technological or organizational improvement, and are more "indicative of innovation," according to Brian Chansky, an economist in the Bureau of Labor Statistics' productivity division.

As the chart above shows, the number of industries with productivity growth typically coincides with economic cycles, cresting during recessions, before peaking in their immediate aftermath. However, the latest recovery "differs from past expansionary periods," said Chansky, noting the relatively steeper and more sustained downtrend since 2010 as the economy enters its ninth year of expansion.

Weak manufacturing productivity in recent years – essentially unchanged since 2011 – has sparked a debate among economists, some of whom see low business investment and outdated infrastructure as the culprits, while others attribute the slump at least in part to a struggle among government statisticians to fully capture rapid technological gains in recent years.

The fact that the total factory productivity figures account for a broader array of factors and still show a consistent downtrend helps weaken the measurement-error theory, at least in manufacturing, according to economist Stephen Stanley of Amherst Pierpont Securities LLC. The data are "very consistent with my contention that a significant chunk of the productivity slowdown reflects a decline in dynamism in the economy," he said, stating that existing fiscal policy and federal regulations are at least somewhat to blame. "We should get a test of that hypothesis soon if we see tax reform and/or a lighter regulatory touch," he said.

Among the 12 largest manufacturing industries surveyed – those with employment over 300,000 – productivity increased in just three in 2015. In the semiconductors and electronic components industry, output rose 3.3%, outpacing a 2.6% increase in costs. Machine shops and threaded-product makers saw the largest drop in efficiency, as flat input costs failed to offset a 4.9% slump in output.Across most of the other large industries, it was an increase in costs that drove down overall performance as the level of goods produced either held steady or increased at a slower rate, the data showed.