Author: Patricia Laya

Manufacturing expanded in February at the fastest pace since August 2014 as factory managers reported stronger orders and production.

The Institute for Supply Management’s index climbed to 57.7, the sixth straight advance, from 56 a month earlier, the Tempe, Arizona-based group’s report showed Wednesday. Readings above 50 indicate growth. The median forecast in a Bloomberg survey of economists was 56.2.

The ISM’s gauge of orders increased to the highest level in just over three years, while an index of production posted its best reading since March 2011. The data were preceded by recent regional indicators showing similar strength that has prevailed since the presidential election as companies begin to step up investment and the global economy stabilizes.

“Things look good at this point,” Bradley Holcomb, chairman of the ISM survey committee, said on a conference call with reporters. “I don’t see anything here, or in the winds, that would suggest we can’t continue with this kind of pace going forward in the next few months.”

Seventeen of 18 industries surveyed by the purchasing managers’ group, the most since August 2014, posted growth in February, including textiles, apparel, machinery and computers. Furniture was the only industry that shrank.

Even while manufacturing sentiment gauges have surged, actual measures of output have shown more moderate progress. The Federal Reserve’s gauge of factory production increased 0.2 percent in both December and January.

Estimates for the ISM’s manufacturing index from economists in the Bloomberg survey ranged from 55 to 58.5.

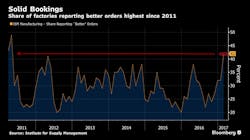

The group’s gauge of new orders increased to 65.1 last month from 60.4 in January. Forty-two percent of purchasing managers said orders were better in February, up from 32 percent in January and the largest share since April 2011.

Order backlogs jumped to 57 from 49.5, the biggest one-month advance in four years. The pickup in unfilled orders indicates production will probably stay strong in coming months. The ISM said 26 percent of purchasing managers reported backlogs were increasing, the biggest share since May 2015.

The measure of export demand improved to 55, close to a December reading that was the strongest since May 2014.

The index of production rose to 62.9 in February from 61.4.

The ISM’s factory employment index fell to 54.2 from 56.1 the prior month, Wednesday’s report showed.

The report also factory inventories expanded in February for the first time since June 2015. Customer stockpiles, however, became leaner. The group’s gauge fell to 47.5, the fastest rate of contraction since April 2016.

A measure of prices paid eased by 1 point to 68. That’s still the second-highest reading since 2011.