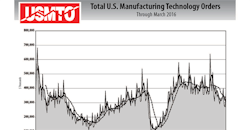

March manufacturing technology orders showed a 36.9% increase over the previous month, according the AMT's monthly USMTO report.

However, orders still were down 11.8% compared to March 2015, and stand at 15.0% down year to date compared to the same point a year ago.

Though the monthly gain appears significant, it is important to note that many manufacturing technology firms close the fiscal year on March 31, which in turn drives activity for orders and sales.

Overall, the immediate industry outlook remains flat.

"While dealing with persistent economic challenges and a softer market that's likely to last into the fourth quarter, manufacturers are leveraging productivity gains to stay competitive," said AMT President Douglas K. Woods.

"The outlook from industry economists improves toward year's end on two particular strengths of the U.S. economy: foreign direct investment and a resurgent consumer base," he added. "For now, manufacturing technology makers are focused on finding markets that offer the best opportunity, like automotive, aerospace and medical. Sentiment among manufacturing executives remains optimistic about future capital equipment investment."

Other economic data from the manufacturing sector has also been tepid. The ISM PMI came in at a lower-than-expected 50.8% for April, and regional Fed surveys for the month were mixed. However, one bright spot was export orders, which rose to a 17-month high.

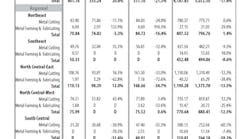

Regional activity for manufacturing technology orders was particularly strong in the Northeast, much of it driven by activity in the aerospace industry. While the Southeast region saw a monthly drop in orders, it is the only region measured by USMTO that has shown a year-to-date gain in orders compared to 2015, much of it coming from the aerospace and automotive industries.

March 2016 manufacturing technology orders were valued at $370.98 million, compared to $420.79 million in March 2015. Year-to-date orders stand at $922.67 million, compared to $1,085.40 million at the same point a year ago.

USMTO data is a reliable leading economic indicator as manufacturing companies invest in capital metalworking equipment to increase capacity and improve productivity.